A health care reform championed by Sen. Paul Gazelka (R-Nisswa) has reduced individual market health insurance rates for the second consecutive year. Commerce Commissioner Jessica Looman attributed 20 percent of the drop to Republicans’ signature legislation of 2017, the Minnesota Premium Security Plan.

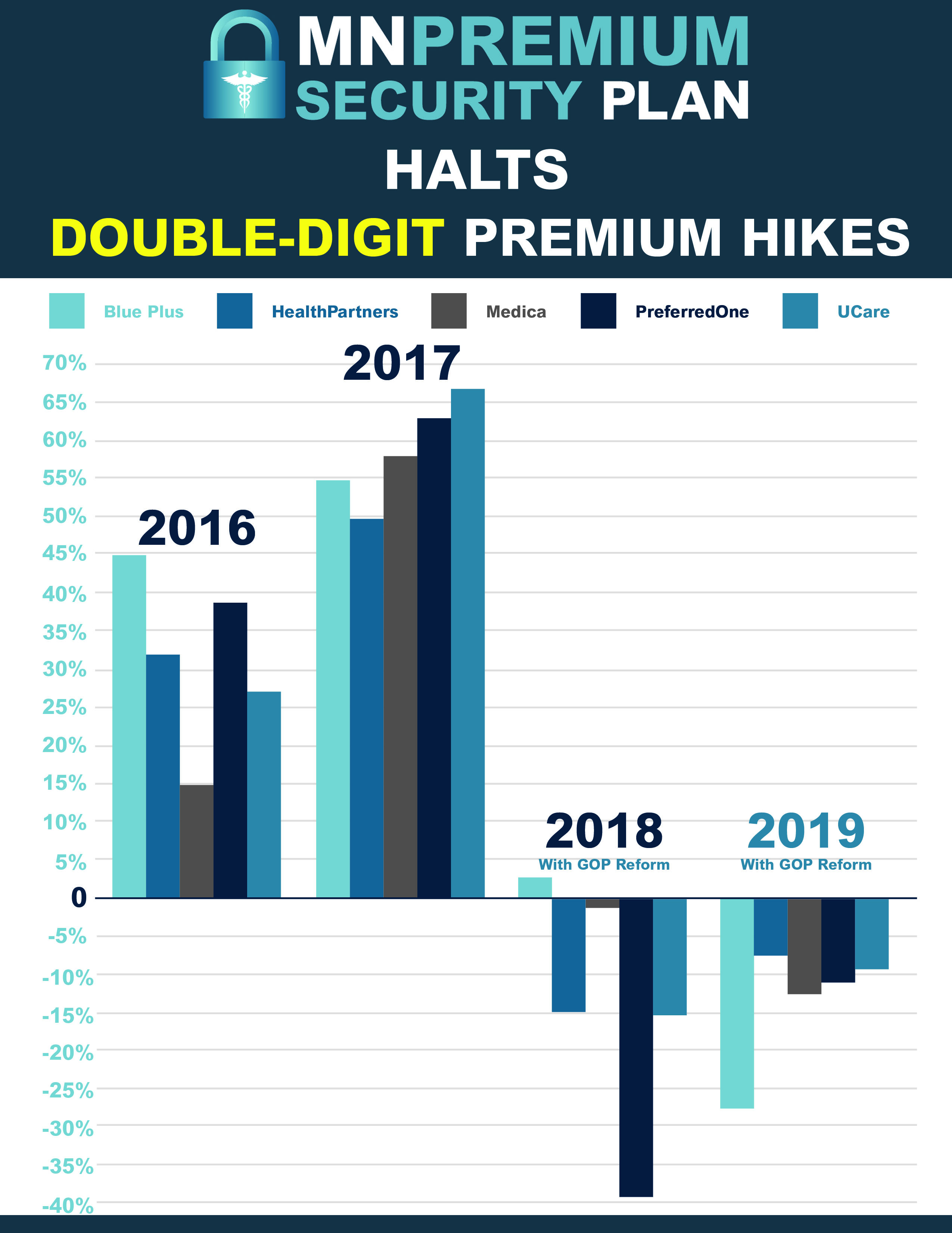

All five of the carriers on the individual market are lowering premiums for 2019, with average rates dropping between 7.4 percent and 27.7 percent. This is in contrast to double digit rate increases every year from 2014-2017, including up to 67 percent for 2017.

The final rates show significant savings for local residents. In Cass, Morrison, Todd, and Wadena counties, a family of four purchasing a silver plan could save $1,644 and a 61-year-old purchasing a gold plan could save $2,544 next year as a result of Republican reforms compared to two years ago.

Between 18-24 distinct health insurance plans will be offered in the four counties, and enrollees will be able to choose between two insurers, Medica and UCare. Todd County and Morrison County residents also will have a third choice, with BluePlus offering plans.

“After years of double-digit premium increases, families are still struggling to afford their health insurance; it’s one of the hardest kitchen-table budget issues in our state. But Republicans’ innovative reforms that are working. Rates would be 20 percent higher this year if we’d done nothing. Now, other states are trying to replicate our success with the Minnesota Premium Security Plan,” said Sen. Gazelka. “There’s no overnight solution to this problem, but I will keep working to lower costs, increase access to doctors, and make health care pricing more transparent so you always get what you’re paying for.”

“The rate decreases in the individual market indicate that this market continues to stabilize,” Commissioner Looman added in a statement.

Republicans also pushed for and successfully passed other key reforms to increase the number of health care options for Minnesotans by expanding agriculture co-op plans and allowing more insurers into the market, a move that is already paying dividends for seniors on Medicare and employees.