It was a busy week in Saint Paul with many late nights. Senate Omnibus bills have made their way to the floor and have been matched with spirited debates.

If you wish to stay up to date, the Senate webpage has a lot of resources to keep Minnesotans informed:

- 2023 Omnibus Budget and Policy Bills

- Senate Schedules — Committee meetings and Floor Session.

- Order of Business — Calendars and Committee reports.

- Bill introductions — Daily list of bills introduced.

- Senate Journal — Official record of daily activity during session.

- Go to a specific page of the Senate Journal

Executive Report:

- Truth in Taxation

- Grant Oversight

- Highway 14/44 Interchange Hearing

- Free State Park Day

Truth in Taxation

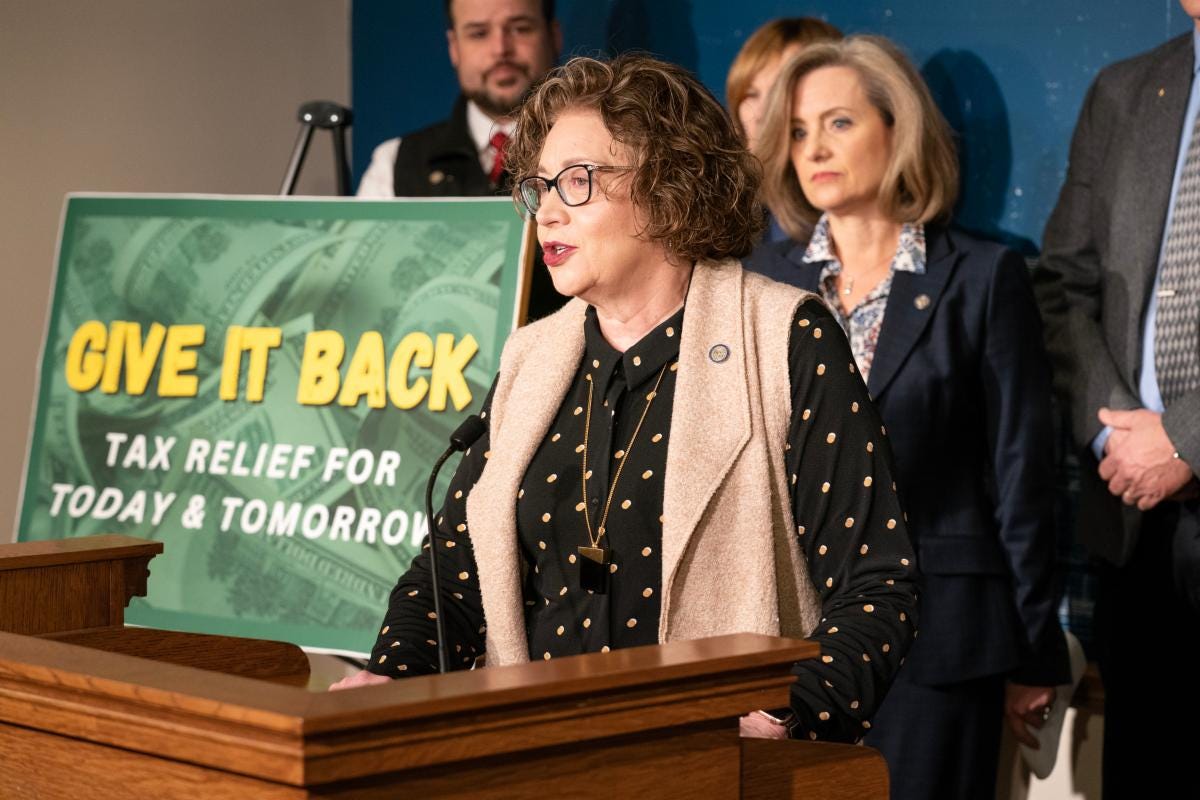

This week, I participated in a press conference to highlight the nearly $10 billion in proposed tax hikes that are included in the Majority’s budget proposals. The tax increases are being proposed despite our state having an overwhelming $17.5 billion state budget surplus.

Riding on the coattails of the tax increases are unfunded mandates on local cities, counties, and school districts. The pile of unfunded mandates and regulations being contemplated will carry tremendous costs for our schools, cities and counties, and that means they will have no choice but to raise property taxes to fund these new mandates. In addition to the nearly $10 billion in tax increases from the state, the last thing Minnesotans can afford is higher property taxes on top of it.

TAX INCREASE DETAILS

These six bills add up to $9.69 billion in higher taxes and fees. There are additional fees in other budget bills and policy provisions, meaning$13 billion in tax increases is not the maximum taxpayers could be on the hook for — it will likely be more.

Transportation Budget Bill: $3.56 billion in tax and fee increases including:

· Motor Vehicle Registration: $736 million tax increase over four years

· Motor Vehicle Sales Tax: $2214 million tax increase over four years

· Retail Delivery Fee $512 million from FY ‘25–27 (remains alive in the House)

Source: Dept of Revenue Analysis on H.F. 2887, April 4, 2023

Housing Bill Metro Sales Tax: $744 million from the (remains alive in the House)

Source: Dept of Revenue Analysis on H.F. 2335, April 3, 2023

Paid Family Medical Leave: $2.9 billion tax increase on every employee and business in the state. Using the most recent non-partisan Senate Fiscal Note, the bill includes a .07% payroll tax to cover benefits beginning in 2025 and takes $1.7 billion from the surplus this year as starter cash.

Source: Non-partisan Senate Fiscal Analysis of H.F. 2, April 13, 2023

5th Tier Income Tax: $1 billion increase with new fifth tier tax; the fourth tier tax level was added under the last DFL trifcta, just 10 years ago.

· If enacted, this would have an impact on this year’s taxes due tomorrow for more than 24,000 returns with an average increase in tax of $9,231 per return.

Source: Dept. of Revenue Analysis of H.F. 442, April 10, 2023

Corporate Franchise Tax: $1.169 billion increase on businesses simply for the “pleasure” of doing business in Minnesota.

Source: Dept. of Revenue Analysis HF 2883, April 10, 2023

Cannabis: $269 million in fees and taxes on legal cannabis

Source: Dept. of Revenue Analysis of HF 100/SF 73, March 31, 2023

Grant Oversight

My bill to provide much needed oversight for tax dollars funding state grants received some attention this last weekend.

“Sen. Carla Nelson, R-Rochester, is sponsoring a bill in response to the Legislative Auditor’s report requiring nonprofits to file tax returns if they receive state money. Her bill, which hasn’t had a hearing, stipulates that nonprofits getting state grants would not be able to pay an employee more than the governor, or have a voting board member who worked for a state agency or served in any elective local or state office. The nonprofits council opposed similar legislation last session.

“We’ve had some bad actors who have taken advantage of our lax controls, and we must not let that happen,” Nelson said. “We must restore the trust.”

Read Star Tribune article about grant oversight here.

Hwy 14/44 Interchange Hearing

On Monday, I presented two bills to the Senate Transportation Committee that would provide funding for the Highway 14/44 interchange, known as one of the most dangerous intersections in southeast Minnesota. Currently, the intersection is at a skewed angle and sees 30,000 vehicles per day traveling at a high rate of speed, with morning commute conditions known to be especially risky.

These road improvements are crucial for the safety and well-being of our residents in Olmsted County. By investing in our infrastructure, we are ensuring a more connected and prosperous community for years to come.

I remain dedicated to advocating for the community’s needs. We must ensure a bright future for Olmsted County, and strong infrastructure is a big step towards that.

· Senate File 981: Olmsted County; U.S. Highway 14 and County State-Aid Highway 44: Provides $42.1 million in bonding money to acquire property, conduct environmental analysis, predesign, design, engineer, acquire right-of-way, construct, furnish, and equip an interchange. Includes the flyover at 7th Street NW and associated infrastructure and road work to accommodate the interchange.

· Senate File 3259: Olmsted County; U.S. Highway 14 and County State-Aid Highway 44: Provides $42.1 million from the general fund to be used to acquire property, conduct environmental analysis, predesign, design, engineer, acquire right-of-way, construct, furnish, and equip an interchange. Includes the flyover at 7th Street NW and associated infrastructure and road work to accommodate the interchange.